Ohmyhome

To acquire a separate family, and other brand of a house for example, is a huge expenses, and it is ergo that numerous banking institutions include family fund within line of lending products. However, to home loans have been needed seriously to create property purchase, its readable how it is assumed which merely can be obtained for that mission.

End up being you to definitely as it might, home loans throughout the Philippines has changed over time, and the pursuing the are the ways you can look so you’re able to they to determine home to your own aspirations.

A home loan was a phrase mortgage studio repaid through monthly amortizations, protected from the a registered first real home financial. The house the mortgage will be placed on need to be one that is fully entitled and you will inserted beneath the label out-of the newest mortgagor or debtor, which can be clear of liens and you can restrictions and has now no legal obstacle as to the validity of one’s term.

Borrowing for domestic purchase

As mentioned, an element of the intent behind home loans is to let borrowers which have the purchase out-of virginia homes. With respect to what can become gotten, such are different with regards to the mortgage supplier, however, generally speaking are:

- Residential household and you may parcel

- Townhouse

- Duplex

- Condo, and you may

- Unused package

Household build

These are empty loads, should you decide already very own these property but i have but really to create property on it, home loans can ways to fund the construction. Although this is not the most common way that people fool around with lenders, it is a readily available solution with quite a few financial institutions.

Along with framework regarding the ground up, a home loan is also useful for renovation and you will house improvement motives, considering the task that must be done are detailed and the price of it could see minimum financing conditions.

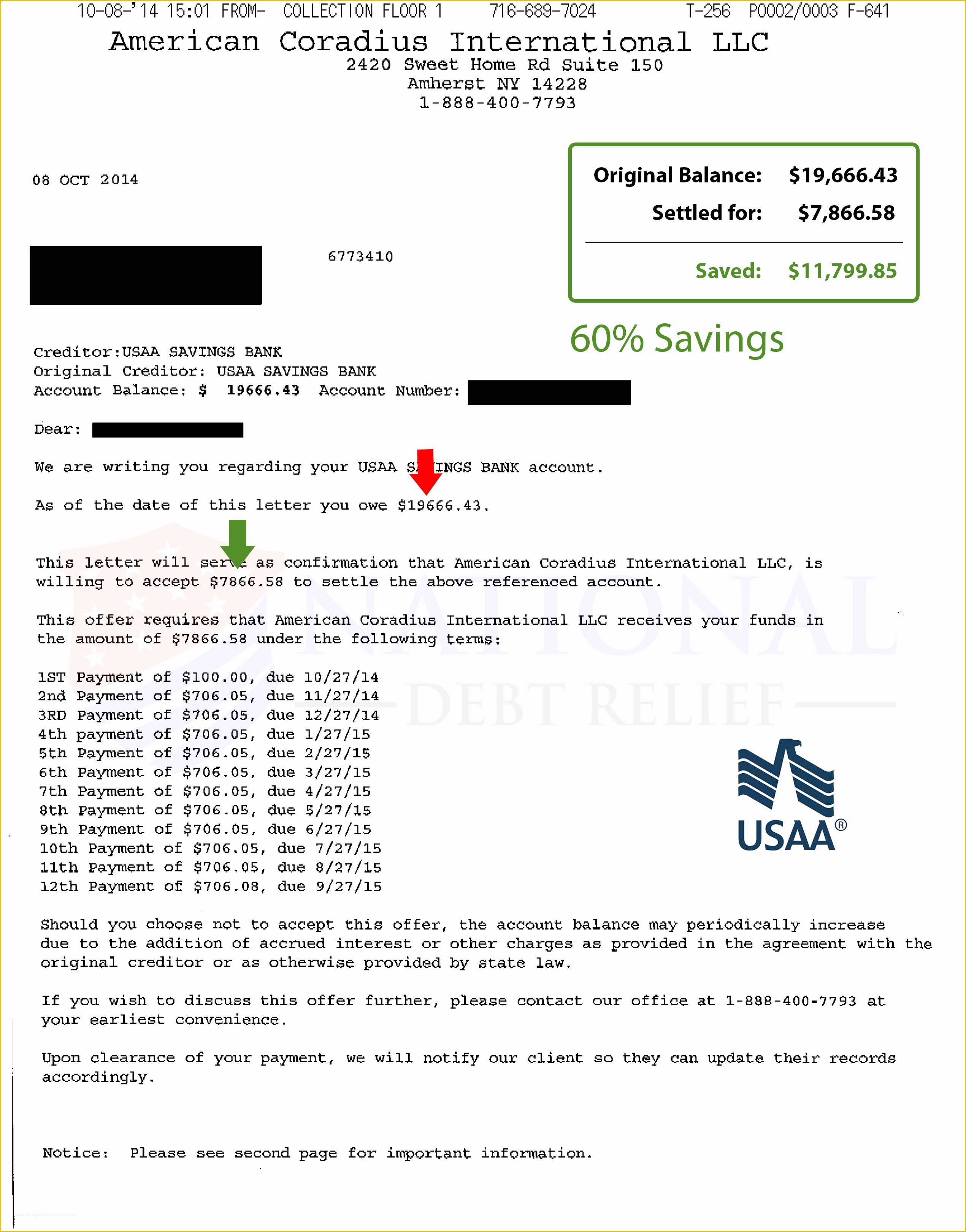

Refinancing/take-off a preexisting mortgage

One to intent behind lenders maybe not commonly used throughout the Philippines, but is provided with most finance companies, is for fee regarding a current home loan. While it is complicated to obtain a loan simply to blow some other loan (it’s seemingly simpler to only pay the current one to), there are advantageous assets to refinancing.

Of the ‘s the opportunity to see an existing mortgage which have not-so-favorable interest rates and you may/or payment terms if you are paying they (in essence, substitution they) having a loan who has focus otherwise terminology that is a lot more good or a much better match one’s most recent economic products.

Probably one of several minimum removed utilizations out of a home loan is actually for the new compensation of fund used to buy otherwise build a new family. It is readable trained with had been purchased, therefore the considering is to try to why acquire. But not, home is a huge expense, and not taking right out that loan tend to departs a serious drop toward lives offers and you will foreseeable cash.

At the same time, mortgage brokers getting reimbursement is an efficient treatment for in reality push through with the acquisition out of a property which is on the market all of a sudden or perhaps in a rush, while the merchant might not be in a position to captivate South Carolina personal loans people who’ll have to go through the normal go out used on getting recognized to possess a mortgage.

The same as locating the house one greatest suits you and you can choice, picking out the financial one top can help you towards Philippines homeownership process. Luckily for us, whether it’s to purchase otherwise strengthening a house, financial institutions give financial solutions used getting any of the above mentioned intentions.

For more information on Philippine banking companies therefore the lenders they offer, or get property issues responded, go ahead and get in touch with Ohmyhome to have expert home guidance. Check out the Ohmyhome assets investment web page to gain access to the best and you will current virginia homes from the Philippines, otherwise download new Ohmyhome software getting simpler accessibility the safely postings and you can relevant real estate functions.

Ohmyhome was released on Philippines in the , following organization’s place out of a development group in the united states in the 2017. Ohmyhome is to start with depending into the 2016, and you can then rose for the Singapore once the a respected PropTech solution and you may registered a house service.

Ohmyhome stretched for the Philippines making sure that Filipino home candidates normally features a genuine property mate that they’ll believe to have their best hobbies planned and certainly will end up being relied upon to help you render outstanding features throughout the entire property excursion.

Presenting a huge number of features all over a few of the Philippines’ big real home brands, Ohmyhome differs from other regional networks because of the going the additional distance and you will commonly permitting people restrict your options and get the fresh new property that best suits the finances, house needs, and you may existence choice.

The company’s Realtors not merely assist in this new shortlisting from possibilities, plus offer top-notch characteristics throughout the to purchase process. They are guidance inside possessions checks, dealings, the brand new finalization of one’s Standards of Marketing, deposit range, the submission out-of assets documents, along with taking buyers regular condition.